威世达-引领全球流量桥接方案 - 威世达

Vistabrokers – World Leading LP Bridge Solution

外汇理财近几年渐渐成为许多人崇尚的职业,毕竟外汇市场在金融业中乃全球最⼤的⾦融体系,其流动性与每⽇交易量已达 6.6万亿美元的规模。除周末和交易中⼼所在国家的重⼤节⽇外, 世界各地的⾦融中⼼按时区开市,使外汇市场能 24⼩时不间断交易各种货币,允许国家与企业通过转换不同的币种来促进国际间的贸易和投资。因现今互联⽹时代的诞⽣而出现了电⼦交易,这让外汇交易成本得以⼤⼤降低,进而提⾼了市场流动性并吸引了很多不同类型的客户。尤其是外汇经纪商通过⽹际⽹路使得外汇交易更容易进⾏,现因外汇交易属场外交易,流通量供应商以及经纪商直接的撮合,使全球投资者已不再需要通过交易所或结算所进⾏交易。种种优势及良好发展前景成功吸引越来越多的投资者踏入外汇市场。

Foreign exchange financing has become a profession that is admired by manypeople throughout these recent years since the foreign exchange market is theworld"s largest financial system in the financial sector, with $6.6 trillion inliquidity and daily trading volume. Except the major weekends and major holidaysin the countries where trading centres are located, the financial centres aroundthe world are opened on time which enable the foreign exchange market to trade awide range of currencies 24 hours a day. Besides that, this also allowsdifferent countries and businesses to promote international trade and investmentby converting different currencies. Electronic trading has emerged as a resultof the advent of today"s Internet age, which has greatly reduced the cost offoreign exchange transactions, thereby increasing market liquidity andattracting variety of customers. Forex brokers, in particular, have made forextrading easier through the Internet, and forex trading currently is considerover-the-counter trading, the direct matching of liquidity providers and brokershas eliminated the need for global investors to trade through exchanges orclearing firms. These various advantages and good prospects for futuredevelopment have successfully attracted more investors from joining the foreignexchange market.

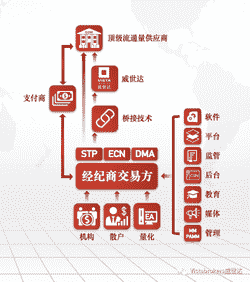

外汇是由许多不同部门及机构联合负责的,当中十分重要的一环便是流动量供应商,英文全称为LiquidityProvider,简称LP。流通量供应商有被分为不同层级,而最顶级的以及流动性最好的便是国家中央银⾏、⼤型商业与投资银⾏了。银⾏同业市场间的买卖点差微不⾜道,使场外参与者⽆从知晓,然⽽市场巨⼤份额导致下个级别的点差将增⼤,当中涉及供应商包括环球银⾏、⾦融机构、主要经纪商及市场庄家等。

Forex is jointly responsible by a number of different departments andinstitutions, one of them which is very important will be the liquidity provider(LP). Liquidity providers are divided into different levels, the top and themost superior will be those national central banks, large commercial andinvestment banks. The spread between interbank markets is negligible, making itdifficult for over-the-market participants to know, butthe huge share of themarket will lead to an increase in the next level of spreads, involvingproviders that include global banks, financial institutions, major brokers andmarket players.

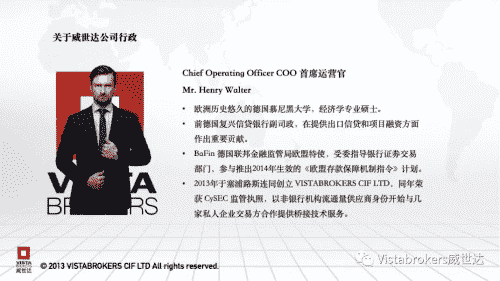

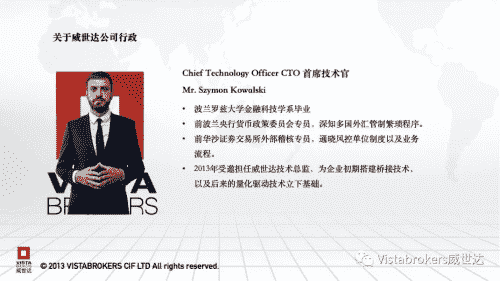

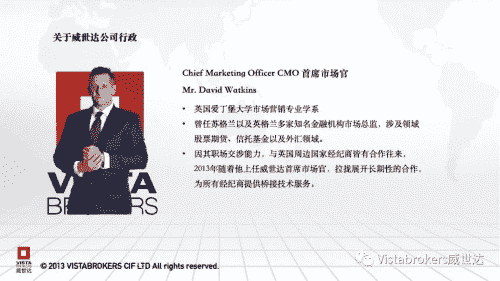

由MR. HENRY WALTER与其团队创立的VISTABROKERS CIF LTD,简称 Vistabrokers,中文名译为 - 威世达,自2013年1月在塞浦路斯共和国成立以来,就以非银行机构流通量供应商,以及具备量化驱动技术的做市商身份,专为欧盟成员国多家私人金融企业以及多家外汇零售经纪商,提供稳定的桥接服务,获得外汇市场上最具竞争力的价格。2013年至2020年期间,无论在速度上对于庞大交易量的执行,还是资产价格合理化的变现能力,更是在避免交易实战中涉及滑点过大的问题处理上,与绝大多数同业相比之下有过之而无不及。

Vistabrokers which is founded by MR. HENRY WALTER and his team in Republicof Cyprus since January 2013 has been a liquidity providers for non-bankinstitutions and a market maker with quantitative driving technology. It hasbeen specially designed for many private financial institutions especially inthe European Union member states. Vistabrokers has been providing stablebridging services and obtain the most competitive prices in the foreign exchangemarket. From year 2013 to 2020, no matter in terms of speed for the execution ofhuge transaction volume, or the ability to realize the rationalization of assetprices, it is also in terms of avoiding the problem of excessive slip page inthe actual transaction, Vistabrokers compared with the vast majority of the sameindustry, there is nothing worse.

作为外汇金融体系中至关重要的一环,威世达为所有合作私人金融企业以及外汇零售经纪商,提供指示性买入价及卖出价,客户在交易平台终端下订单则意味着接受威世达的报价。所有提交订单通过威世达的桥接技术以及ECN电子通讯网络撮合系统,最终将向最顶级流通量供应商处理所有订单。为了向外界看到公司身为优质流通量供应商的实力,威世达提供资⾦安全与协议条款还有服务器及桥接技术两大优势于经纪商们。

As a vital part of the foreign exchange financial ecosystem, Vistabrokersalways provides indicative buying and selling prices for majors cooperativeprivate financial companies and foreign exchange retail brokers where retailsplacing orders on the trading platform terminal are accepting the quotation fromVistabrokers. All submitted orders will be processed through Vistabrokerssbridge technology and ECN electronic communication network matching system, andfinally will be processed to the top-tiers of liquidity providers. In order toprove the strength of Vistabrokers as a superior liquidity provider,Vistabrokers provides funding security and agreement terms, as well as serversand bridging technology for the brokers.

首先,这意味着合作经纪商签署保密协议之后,将预缴保证⾦并提供持有资产表,确保其稳定性以及财务健康状况。流通量供应商以及部分经纪商基本以市商模式运⾏,成为经纪商客户交易的对⼿⽅。至于基础设施以及桥接技术上,威世达在全球多个据点设立服务器,确保⾼效执⾏订单能⼒之余,结合市场上主要桥接技术供应商为所 有合作经纪商提供尖端桥接服务, 避免了交易实战中涉及拒绝报价 以及滑点过⼤的问题发⽣。

First of all, this means that the cooperative broker will prepay thedeposit and provide a balance sheet after signing the confidentiality agreementto ensure its stability and financial health. Liquidity providers and somebrokers basically operate in the market business model and become the counterparty of the broker"s client transactions. As for the server and bridgingtechnology, the server set up in multiple locations around the world, whichensures the ability to execute orders efficiently, and combines with the majorbridging technology suppliers on the market to provide cutting-edge bridgingservices for all cooperating brokers, avoiding problems involving refusal ofquotations and excessive slip page in actual trading.

塞浦路斯共和国位于地中海东部的塞浦路斯处于亚洲与欧洲的交界处,自 2004年加入欧盟成员国后的塞浦路斯,该国所注册的企业可在所有欧盟成员国内运营业务,国家金融监管框架更是进行大幅度改动,重点规划投资者教育培训以及现代化建设。凭着证券交易委员会的成立,除了金融领域的高效发展,监督机制得到严厉执行以外,更是成为了欧盟金融工具市场法规Markets in Financial Instruments Directive ,MiFID重要结构体系,使塞浦路斯国在欧盟成员国内扮演着举足轻重的角色。

Located in the eastern Mediterranean, Cyprus is at the junction of Asia andEurope. Since Cyprus joined the EU member states in 2004, companies registeredin the country can operate businesses in all EU member states, and the nationalfinancial regulatory framework has undergone significant changes, focusing oninvestor education and training and modernization. With the establishment of theSecurities and Exchange Commission, in addition to the efficient development ofthe financial sector and the strict implementation of the supervision mechanism,it has also become an important structural system of the EUs Markets inFinancial Instruments Directive and MiFID, enabling the State of Cyprus to playa pivotal role in the EU member states.

这意味着任何一家公司只要在塞浦路斯注册,就可以自由自在将业务带入全部的欧洲市场。另外,塞浦路斯在2008年开始使用欧元之后,发生了大量变化,CySEC更被视为了一间有信誉的监管机构,获得牌照能让客户感到更安全及更受保护。

This means that any company registered in Cyprus is free to bring itsbusiness to all European markets. In addition, Cyprus has changed a lot since itbegan using the euro in 2008, and CySEC is seen as a reputable regulator, withlicences that make customers feel safer and more protected.

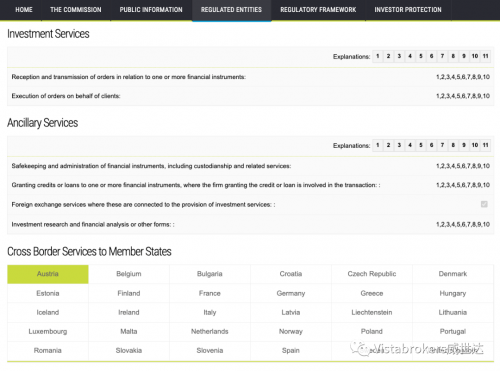

威世达持有塞浦路斯证券交易委员会金融监管机构 CySEC 的金融监管执照。

Vistabrokers holds a financial regulatory license from CySEC, the financialregulator of the Cyprus Securities and Exchange Commission.

执照号码 License Number:190/13

颁发日期 Issue Date : 2013年1月24日

完整执照详情查询链接:

For full license details, please access to the website below:

塞浦路斯证券交易委员会旗下所成立 Investor Compensation Fund ICF(投资者赔偿基金),该基金范围涵盖投资服务、投资活动、受监管市场的运作和其他相关事宜,旨在保护客户投资权益。根据塞浦路斯法律规定,凡是登记为 ICF的公司出现财务问题且无法正常向客户履行财务义务,例如已导致交易者损失资金,却没能力支付赔偿时,ICF将保护该经纪商的客户资金安全并支付其客户应得的资金。在这种情况下,交易者便可向ICF 申请赔偿。

The Investor Compensation Fund, ICF is established by the Cyprus Securitiesand Exchange Commission. It covers investment services, investment activities,the operation of regulated markets and other related matters to protect clients"investment interests. According to Cypriot law, ICF protects the client"s fundsand pays its clients" dues if a company that is registered as ICF has financialproblems and is unable to perform its financial obligations to clients properly.For example, it has caused the trader to lose funds, however, it is unable topay their clients the compensation. In this case, the trader can apply to theICF for compensation.

威世达持有塞浦路斯证券交易委员会金融监管机构 CySEC 的金融监管执照,也同时持有 ICF。

Vistabrokers holds a financial regulatory license from CySEC, the financialregulator of the Cyprus Securities and Exchange Commission, as well as anICF.

完整执照详情查询链接:

For full license details, please access to the website below:

威世达主要投资服务为接受和传递⼀个或多个⾦融⼯具相关订单,同时也代表客户执⾏订单。值得一提的是,成立于塞浦路斯的威世达在成立当年的短时间内,就顺利成功申请到了该国金融监管执照,CySEC以验证公司的极高安全性。不仅如此,威世达创立至今凭着超高性能成功于2020年获得有关奖项,例如Britain Noble Fin-Tech Awards所颁发的最佳金融科技流通量供应商奖以及第九届国际至尊品牌大奖所颁发的-年度最佳流量供应商品牌。该两项荣耀对威世达而言是支强心针,因为能大大增加各大经纪商对公司的信心。

The main investment services of Vistabrokers are reception and transmissionof orders in relation to one or more financial instruments and execution oforders on behalf of clients. It is worth mentioning that, Vista has successfullyapplied for the country"s financial regulatory license, CySEC which verifies thecompany"s extremely high security in the short period of time since the companyestablishment in Cyprus. Moreover, Vistabrokers has been awarded 2 awards in2020 for its superior performance. For instance, the Best Fin-Tech LiquidityProvider from Britain Noble Fin-Tech Awards and the Best Liquidity Provider ofthe Year from the 9th International Prestige Brand Awards. These honours hasgreatly increased the confidence of more major brokers towards Vistabrokers.

除了通过奖项成为了优秀的流通量供应商,威世达⾃2013年成⽴⾄今也凭着执⾏效率以及技术⽔平的提升,已经在欧盟成员国内,站稳主要经纪商以及市场庄家的(2级)流通量供应商⾝份。威世达一直秉持着自己的理念,便是与全球各地的外汇交易场所合作,不断改良量化驱动技术,持续性地提供稳定流动性,帮助全球参与者在威世达涵盖的资产类别中获得有竞争⼒的价格,最后成为全球领先的做市商。

Not only becoming a superior liquidity provider through wining the awards,Vistabrokers has established itself as a major broker and market maker (tier 2)as a liquidity supplier in the EU member states with its execution efficiencyand technical improvements since its establishment in 2013. Vistabrokers hasdetermination on own philosophy which is cooperate with foreign exchange tradingplatforms around the world, continuously improve quantitative drivingtechnology, continue to provide stable liquidity, help global participants toobtain competitive prices in the asset classes covered by Vistabrokers, andbecome the world"s leading market maker Quotient.

接着,威世达也为今年设下新目标,将以⾰命性全新姿态⾯向全球⾦融市场,本着 “人人可成为移动流量商”的特许经营理念率先打破现有传统⾦融⾏业的缺口,创造⼀个流通量供应商、经纪商、特许经营商三⽅互惠互利的“三赢”局⾯。在2020年至2022年间,威世达将通过与特许经营商合作,将业务发展至全球各个地区及城市。立志于2023年至2025年期间,威世达全球市场版图拓展至30万名特许经营商,打造充足上市数据,进而拓展更多金融板块,最后立志成为全球十大顶级流通量供应商之一。

Moreover, Vistabrokers also sets a new goal for starting from this yearwhich is will face the global financial market with a revolutionary newattitude, and will be the first to break the gap in the existing traditionalfinancial industry based on the franchise concept of “Everyone can be Mobile-LP”and create mutual benefits among Vistabrokers, brokers and franchisees. Withinthe year of 2020 and 2022, Vistabrokers aims to expand its business to variousregions and cities around the world through cooperation with franchisees. Withinthe year of 2023 and 2025, Vistabrokers aims to expand its global marketfootprint to 300,000 franchisees, hence created sufficient listing data, andexpanded into other financial sectors, determined to become one of the worldstop ten tier 1 liquidity providers.